The Global Seam Tapes Market: Sealing the Future of Performance and Protection

The global Seam Tapes Market is undergoing a period of significant technical evolution and market expansion. Once a niche component used primarily in high-end rainwear, seam tapes—adhesive strips applied to sewn seams to prevent the ingress of water, air, and chemicals—have become a critical enabler for a multi-billion dollar ecosystem spanning apparel, automotive, healthcare, and construction.

As industries pivot toward “smart” textiles and high-performance materials, the demand for reliable, lightweight, and durable sealing solutions has never been higher.

Market Size and Growth Projections

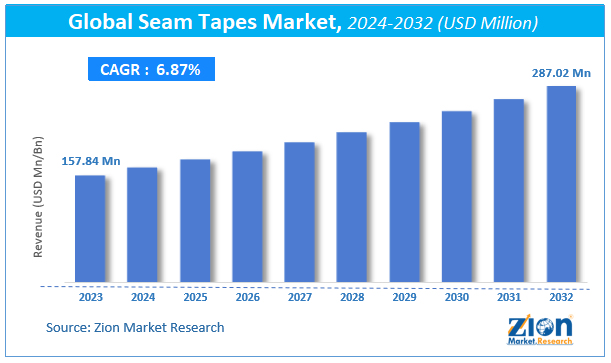

The Seam Tapes Market is characterized by steady, resilient growth across various high-value sectors. While market valuations can vary based on whether “seam sealing” is grouped with broader adhesive tapes, specialized reports provide a clear upward trajectory:

-

Market Valuation: The specialized seam sealing tapes market was valued at approximately USD 280 million to 310 million in 2024.

-

Forecast (2030-2035): Projections suggest the market will reach between USD 440 million and USD 580 million by 2030-2034.

-

Growth Rate: The market is expected to expand at a Compound Annual Growth Rate (CAGR) of 6.7% to 8% through 2032.

Geographically, the Asia-Pacific (APAC) region remains the powerhouse of the market.5 Hosting the world’s largest garment and automotive manufacturing hubs (China, Vietnam, India, and Bangladesh), APAC accounted for the largest revenue share in 2024 and is expected to maintain the highest CAGR.6 North America and Europe follow closely, driven by a surge in demand for premium outdoor gear, military-grade textiles, and stringent energy-efficiency building codes.

Key Market Segments

The market is defined by the chemistry of its materials and the specific demands of its end-users.

1. By Material Type

-

Polyurethane (PU): Dominating over 60% of the market share, PU is the gold standard for apparel. It offers exceptional flexibility, a soft “hand-feel,” and superior resistance to UV exposure and weathering.

-

Polyvinyl Chloride (PVC): Primarily used in heavy-duty industrial applications, tents, and tarpaulins due to its cost-effectiveness and robust waterproofing capabilities.

-

Thermoplastic Polyurethane (TPU) & Polyamides: These materials are gaining traction in the automotive and footwear sectors where high heat resistance and structural bonding are paramount.

2. By Application and End-Use

-

Apparel & Footwear: This remains the largest segment (holding roughly 36% of the share). The explosion of “Gorpcore” (utilitarian outdoor fashion) and high-performance activewear has made seam sealing a standard consumer expectation.

-

Healthcare (Medical Textiles): Following the COVID-19 pandemic, the demand for seam-sealed Personal Protective Equipment (PPE) surged. Seam tapes are critical in creating surgical gowns and hazmat suits that provide a 100% barrier against infectious agents.

-

Automotive: One of the fastest-growing niches. Seam tapes are used for weatherproofing door panels, insulating HVAC ducts, and securing interior wire connections.

-

Construction: Driven by “green building” mandates, seam tapes are increasingly used to seal architectural membranes and vapor barriers, ensuring airtight envelopes that reduce energy consumption.

Leading Market Drivers

Several catalysts are pushing the seam tapes market into a new era of adoption:

-

The “Athleisure” and Outdoor Boom: A global shift toward health and fitness has fueled a massive market for hiking, running, and water-sports gear. Consumers now demand “triple-threat” apparel: waterproof, windproof, and breathable.

-

Advancements in Technical Textiles: The rise of ultra-thin, lightweight fabrics requires equally advanced tapes that can bond at lower temperatures without damaging the substrate.

-

Energy Efficiency Regulations: In the construction sector, stricter laws regarding air infiltration are forcing contractors to move away from traditional caulks and sealants toward precision seam tapes for windows, doors, and roofing.

-

Automotive Electrification: As EVs prioritize noise reduction and cabin comfort, specialized acoustic seam tapes are being used to seal gaps and dampen vibrations more effectively than traditional liquid adhesives.

Critical Challenges and Restraints

Despite the positive outlook, manufacturers must navigate several hurdles:

-

Volatile Raw Material Prices: Most seam tapes are petroleum-based derivatives. Fluctuations in global oil prices and supply chain disruptions for resins (like Piperylene) can squeeze manufacturer margins.

-

Emergence of Substitutes: Advanced technologies like ultrasonic welding and laser bonding can sometimes eliminate the need for traditional tape by fusing fabrics directly together.

-

Sustainability Pressures: Conventional tapes often use non-biodegradable polymers. There is an increasing regulatory push (particularly in the EU) for “circular” textiles, forcing a shift toward bio-based or recyclable adhesives.

Competitive Landscape: Innovation as a Strategy

The market is a mix of massive diversified chemical companies and specialized textile engineering firms. Key players include:

| Company | Key Strategy / Focus |

| Bemis Associates Inc. | Global leader; focused on thermoplastic films and recent acquisitions in visibility/safety textiles. |

| 3M Company | Diversified giant; dominant in automotive and industrial-grade sealing solutions. |

| Toray Industries Inc. | Innovation leader in carbon-fiber-reinforced materials and high-speed integrated molding. |

| Sealon | Strong presence in the Asian garment manufacturing sector with high-performance PU tapes. |

| Gerlinger Industries | Focused on technical applications and European industrial standards. |

The Future Outlook: Smart Tapes and Sustainability

Looking toward 2030, the “next big thing” in the seam tapes market is the integration of Smart Technology. Researchers are developing tapes embedded with sensors that can monitor the structural health of a building or the physiological state of a soldier wearing a smart uniform.

Furthermore, the eco-friendly transition is no longer optional. The development of solvent-free, water-based adhesives and biodegradable backing materials will define the next generation of market leaders. Companies that can provide a “green” seal without compromising the 100% waterproof guarantee will capture the highest market premiums.

Would you like me to develop a more specific analysis on the Automotive Seam Tape segment or perhaps a detailed look at the Sustainable/Eco-friendly innovations currently hitting the market?